Nation unveils new rules for earthquake cover to boost disaster protection

China launched catastrophe insurance on Tuesday, unveiling new rules to cover earthquake insurance.

Top regulators said the moves were part of the country's efforts to improve the insurance sector and work for disaster reduction and mitigation.

By the end of 2017, finalized rules on earthquake insurance and an insurance fund for catastrophes will be established, according to a step-by-step plan that has mapped out for the catastrophe insurance system in China.

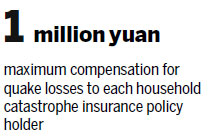

Each household purchasing catastrophe insurance covering earthquakes in the policy may be compensated by up to one million yuan ($153,300) if an quake causes asset losses, under the plan, jointly released by the China Insurance Regulatory Commission and the Ministry of Finance.

Householders will also be able to buy insurance from more than one insurer.

Analysts said that China needed integrated data on catastrophe forecasts, records and monitoring to help insurers write policies covering a variety of situations in a vast land which may be hit by future natural disasters.

"It is a good move forward for the insurance sector and for residents who will be able to buy insurance policies. Technically speaking, it is essential to collect enough data for modeling and actuarial studies, which are really important for insurers when they write policies," said Tony Chung, Shanghai-based insurance consultant with Heng Tai Wealth Management Ltd.

He said that for residents who were exposed to the risk of earthquakes and other catastrophes, it was important to raise their awareness of buying insurance covering those disasters.

"Policy values for such disasters may become really high so premiums need to be high, too, and the combined premium must reach a certain level before the plan can work," Chung said.

Currently reconstruction work after natural disasters such as earthquakes, floods, typhoons, mudslides and fires, is mostly financed by the government as well as by charities and through donations.

Under the planned pilot program, the risks of catastrophes will be shared between governments, insurance and reinsurance firms and individuals, which analysts say will help the country better leverage its resources and financial tools, strengthening its capacity to handle risks.

Between 2017 and 2020, catastrophe insurance will be promoted nationwide, covering a wide range of disasters, as a part of the country's system for disaster prevention and mitigation.

Analysts said catastrophe insurance will supplement the current insurance system in China, taking advantage of financial vehicles to strengthen the country's risk management capacity.

As many as 45 asset insurers will be engaged in the pilot program for catastrophe insurance covering earthquakes.

According to a CIRC report, the local governments of some cities and provinces, such as Ningbo in Zhejiang province, Sichuan province and Yunnan province, have piloted using government funds to buy commercial insurance for residents.

More detailed rules on the pilot program will be introduced, according to the plan.

Shares of insurers listed in Shanghai and Shenzhen put in a mixed performance on Tuesday after the plan was released.

wuyiyao@chinadaily.com.cn

(China Daily 05/18/2016 page14)